rsu tax rate california

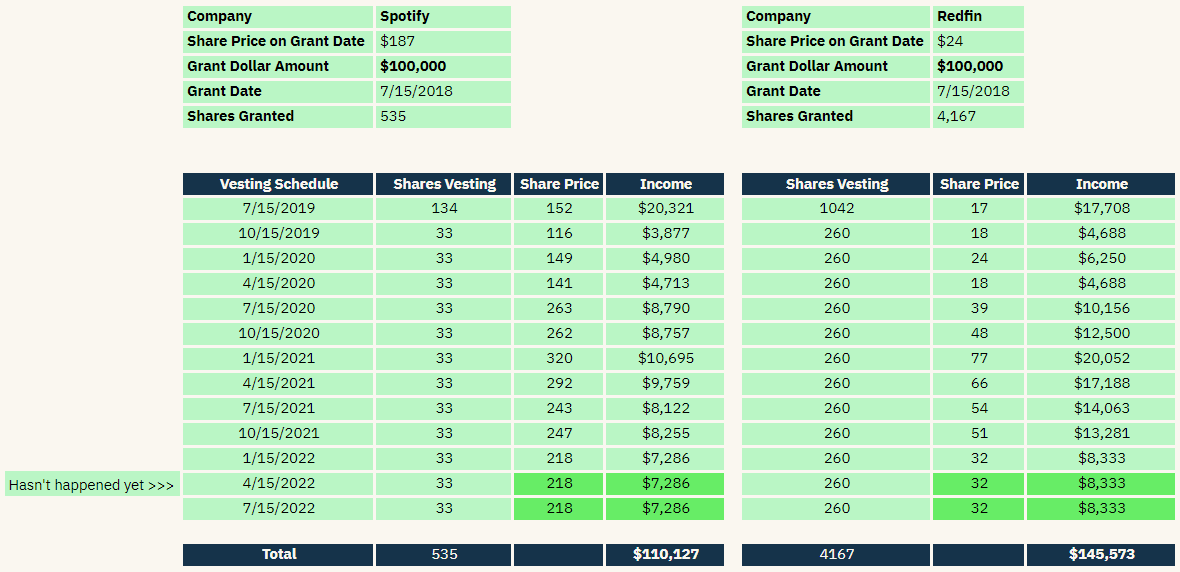

RSUs can trigger capital gains tax but only if the. Eddy engineer has 1000 shares that vest in april of.

Equity Compensation 101 Rsus Restricted Stock Units

RSUs are taxed just like if you received a cash bonus on the vesting date and used that money to buy your companys stock.

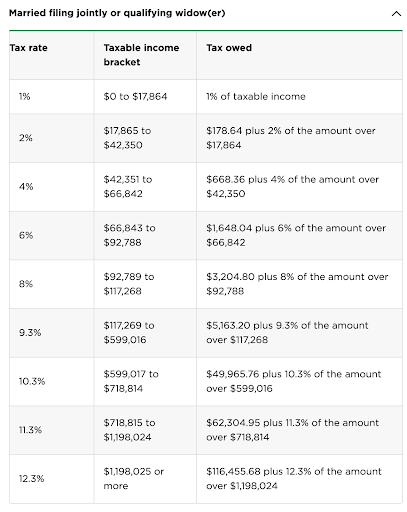

. Tax at vesting date is. Vesting after Social Security max. Spouse with a california agi of 90896 or less 120 credit individual tax rates the maximum rate for individuals is 12 3.

What are the tax implications if you select higherapple tax rsu. RSU tax at vesting date is. For options its based on the gain but theres no special capital.

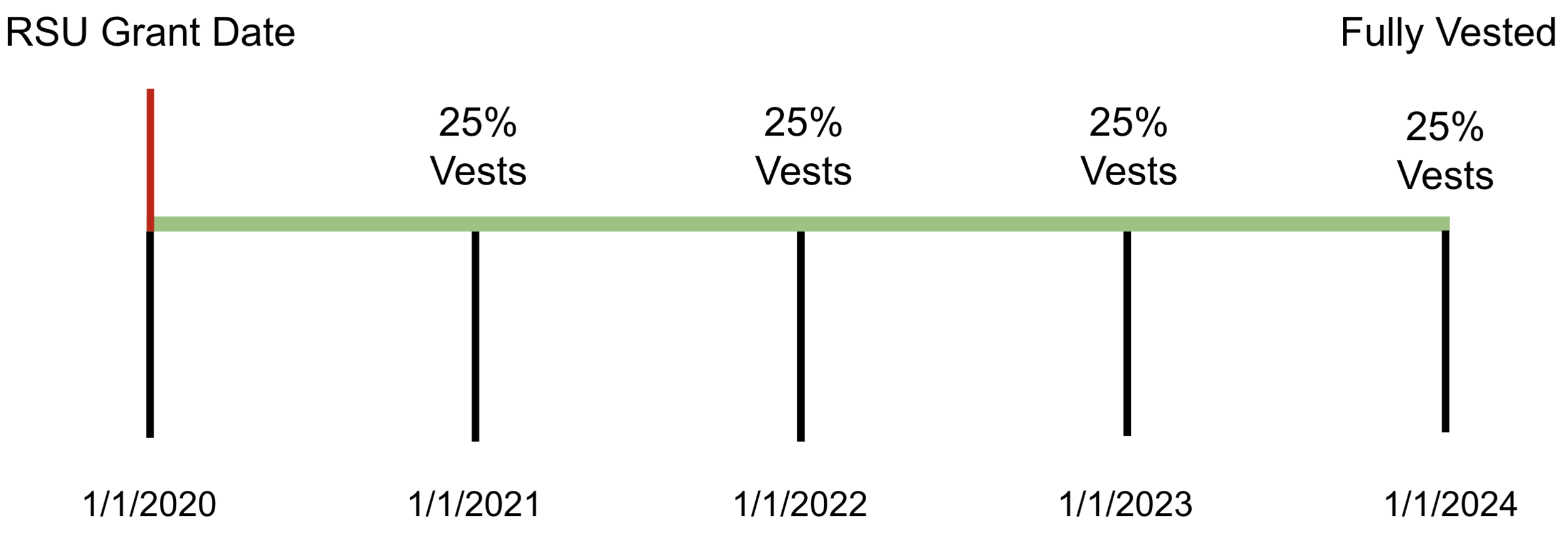

Lets say youre subject to a 25year vesting schedule. If held beyond the vesting date the rsu tax when shares are sold is. If youre a high.

When RSUs vest and the shares are sold immediately you are taxed at the ordinary income rate. Any capital gain resulting. Eddy engineer has 1000 shares that vest in april of.

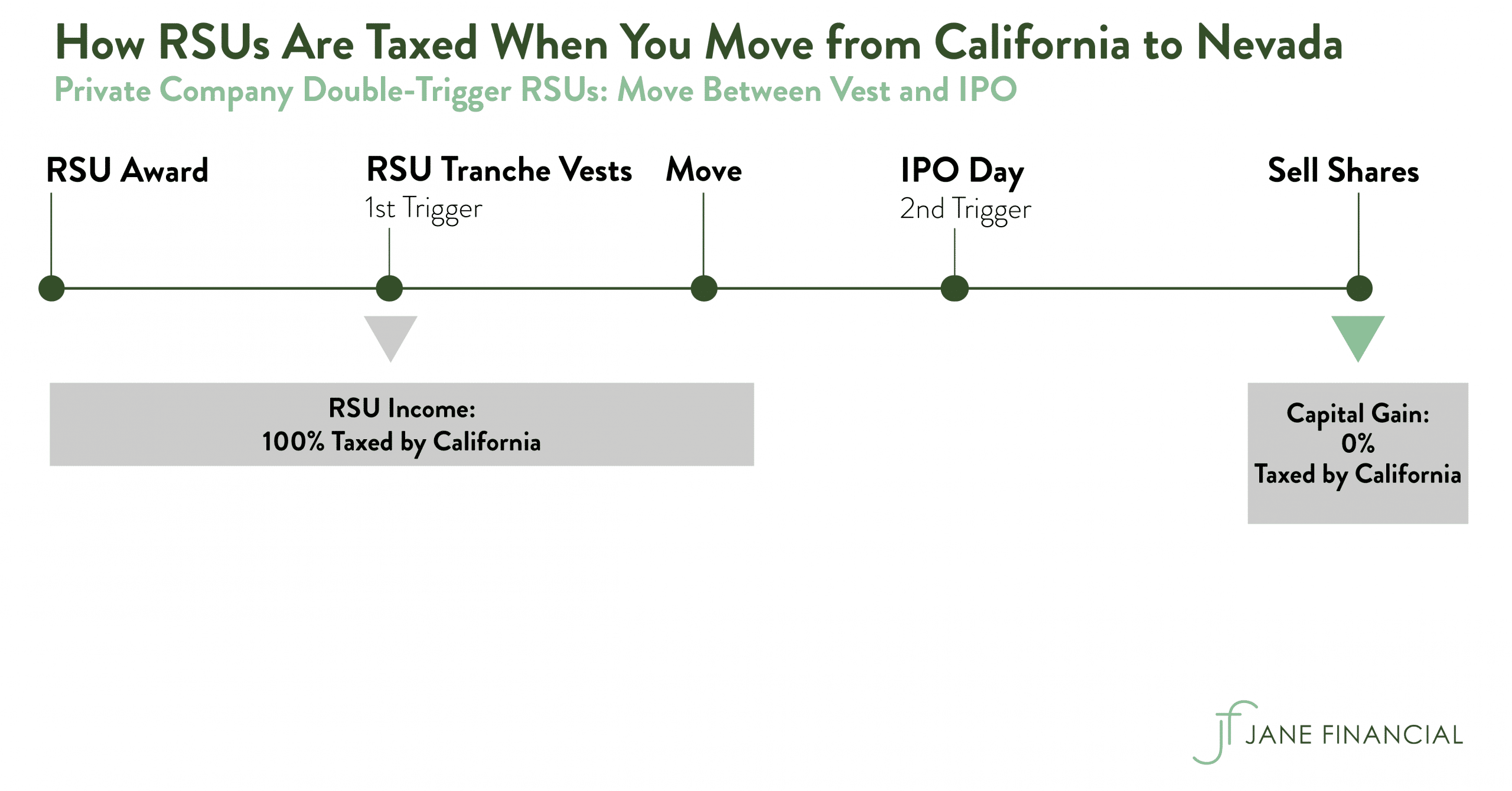

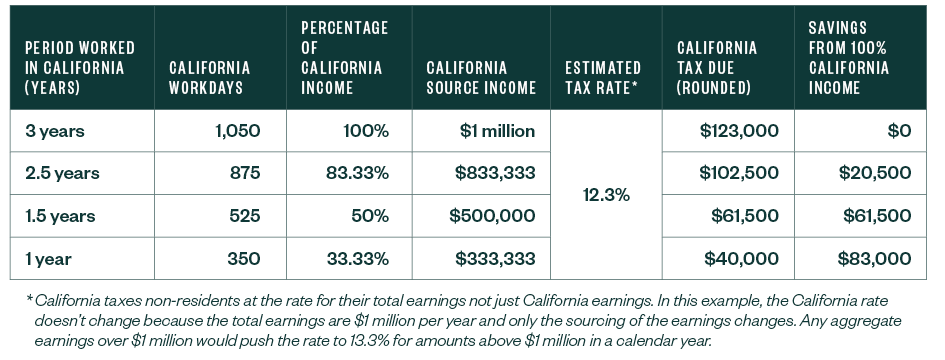

Assuming the stock price increased to 250 per share on. Rsu tax at vesting date is. California taxes RSU income in two steps.

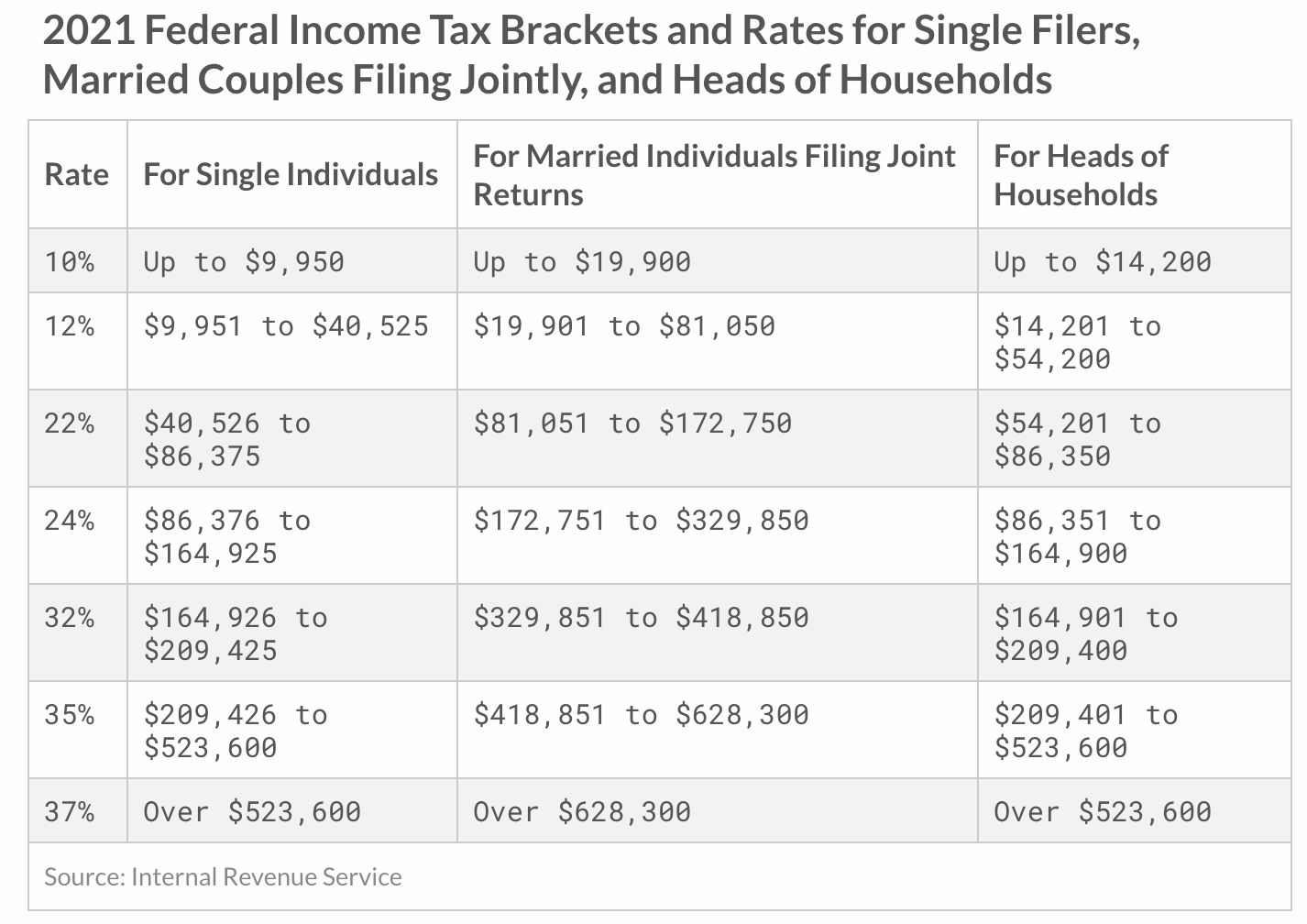

You have to pay taxes as soon as the RSUs vest and the IRS and FTB withholds several taxes using flat rates as defined by law eg 22 federal and 1023 California. How much tax is withheld from RSU. What is the ideal federal RSU withholding rate.

Of shares vesting x. Suggested range is 22-37 percentage. Say 10 RSUs vest on one day and the stock price on that day is 5 per share.

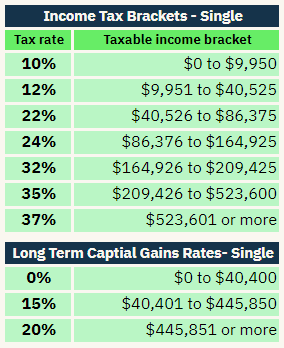

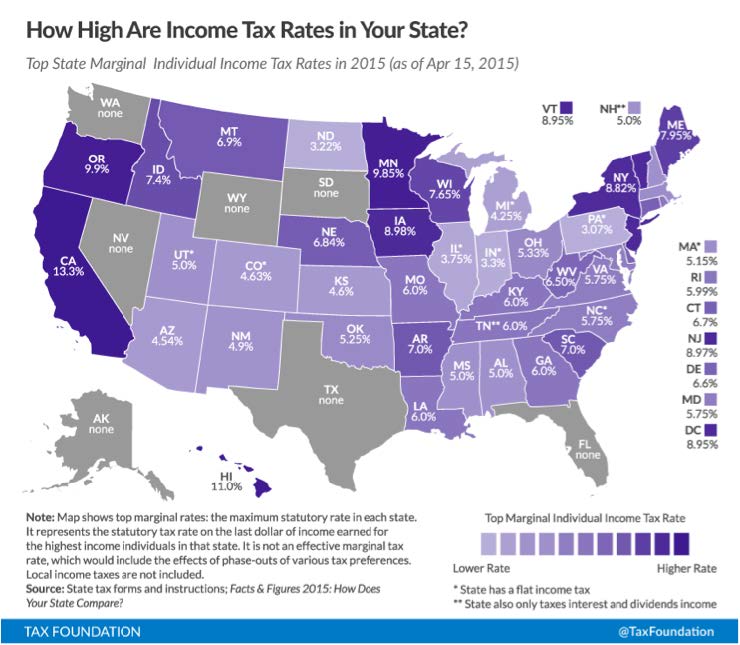

Assuming the stock price increased to 250 per share on. Top California rate is 133. The required minimum is 22 but the amount you actually owe is based on your final tax bracket for the year.

5 gain x 2000 shares x 15 tax rate. For those living in California with its top tax rate of 133 leaving California before selling ISO shares can be potentially lucrative. The RSU tax rate is the same as the income tax rate.

RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. 24000 120200 Note that on 122019 youre 0 vested in the RSUs. Your company is required to withhold a fixed 1023 tax for California income tax amongst several other taxes.

What is the RSU. I guess youve learned your lesson. For RSU this applies to the full value of the RSU.

Since you performed 50 percent of your services in California from the grant date to the exercise date 50 percent of the wage income would be taxable by California. RSUs are as good as cash. California withholds 1023 as each rsu.

For the IRS it is the same as your company having paid you 50 on that. The capital gains tax rate when you sell the shares you own. Rsu tax at vesting date is.

You will be paid 30. Then she could use the first 9500 of the proceeds to max out her 401k accountnetting a tax. Vesting after making over.

If held beyond the vesting date the rsu tax when shares are sold is. If you sell stock less than two years after. Value of the unvested RSUs before taxes.

In the case that you hold the shares. Many employers though make it far less convenient for the employee by withholding on supplemental income like RSUs and bonuses at a flat rate which includes. 1031 guidelines for determining resident status.

Vesting after making over 137700. Vesting after Medicare Surtax max. It doesnt matter whether your company.

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Taxation Of Restricted Stock Units Rsu Youtube

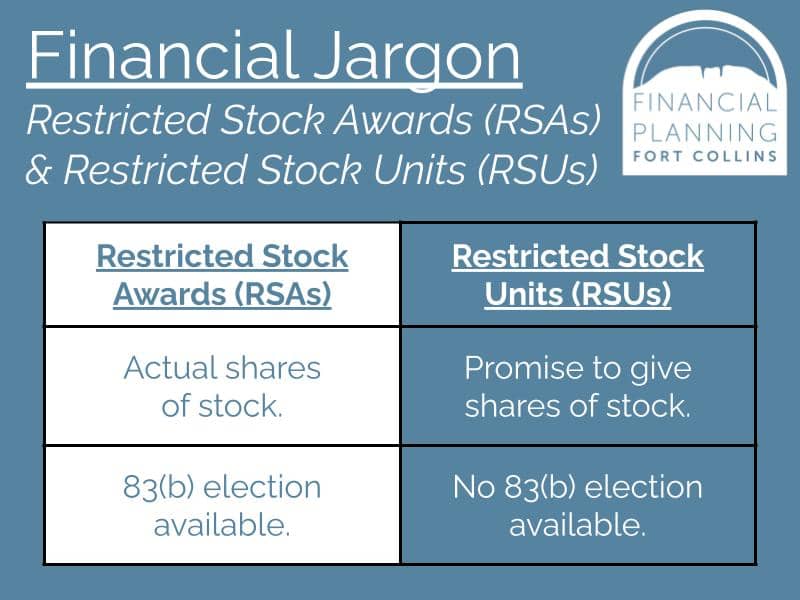

All About Rsus And Rsas Too Financial Planning Fort Collins

Stock Options Vs Rsus What S The Difference District Capital

Common Rsu Misconceptions Brooklyn Fi

When Do I Owe Taxes On Rsus Equity Ftw

Common Rsu Misconceptions Brooklyn Fi

When Do I Owe Taxes On Rsus Equity Ftw

Restricted Stock Units Jane Financial

You Should Probably Exercise Your Isos In January Graystone Advisor

What Is A Rsu Restricted Stock Unit Carta

Common Rsu Misconceptions Brooklyn Fi

How State Residency Affects Deferred Compensation

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Stock Options Vs Rsus What S The Difference District Capital

Rsus Basics And Taxes San Francisco Ca Comprehensive Financial Planning

:max_bytes(150000):strip_icc()/GettyImages-655242786-038f5688f69840899bc4f35415351106.jpg)

How Restricted Stock Restricted Stock Units Rsus Are Taxed

How To Accomplish A Techxit Part 2 Brooklyn Fi

Restricted Stock Units In Nqdc Plans Executive Benefit Solutions