does arizona have a solar tax credit

Buy new solar panels in Arizona and get a 25 credit of its total cost against your personal income taxes owed in that year. Arizona and Massachusetts for instance currently give state income tax credits worth up to 1000 toward solar installations.

Canadian Solar Incentives Rebates And Tax Credit Programs Federal Provincial

Most solar systems will get the full 1000.

. The Arizona state solar tax credit is equal to 25 of system costs or 1000 - whichever is lower. Minimum Dollar Requirements for the Arizona Charitable Tax Credit. Installation of the PV system must have been between January 1 2006 and December 31 2019.

Credit for Contributions Made or Fees Paid to Public Schools. The credit amount allowed against the taxpayers personal income tax is 25 of the cost of the system with a 1000 maximum regardless of. Additionally if the amount of the credit exceeds a taxpayers liability in a certain year the unused portion of the credit may be carried forward to following tax years.

Arizona Residential Solar Energy Tax Credit. Arizona offers state solar tax credits -- 25 of the total system cost up to 1000. Arizona solar tax credit Every resident in Arizona who installs solar panels gets a State Tax Credit of 25 of the total system cost up to 1000 to be used toward State income taxes.

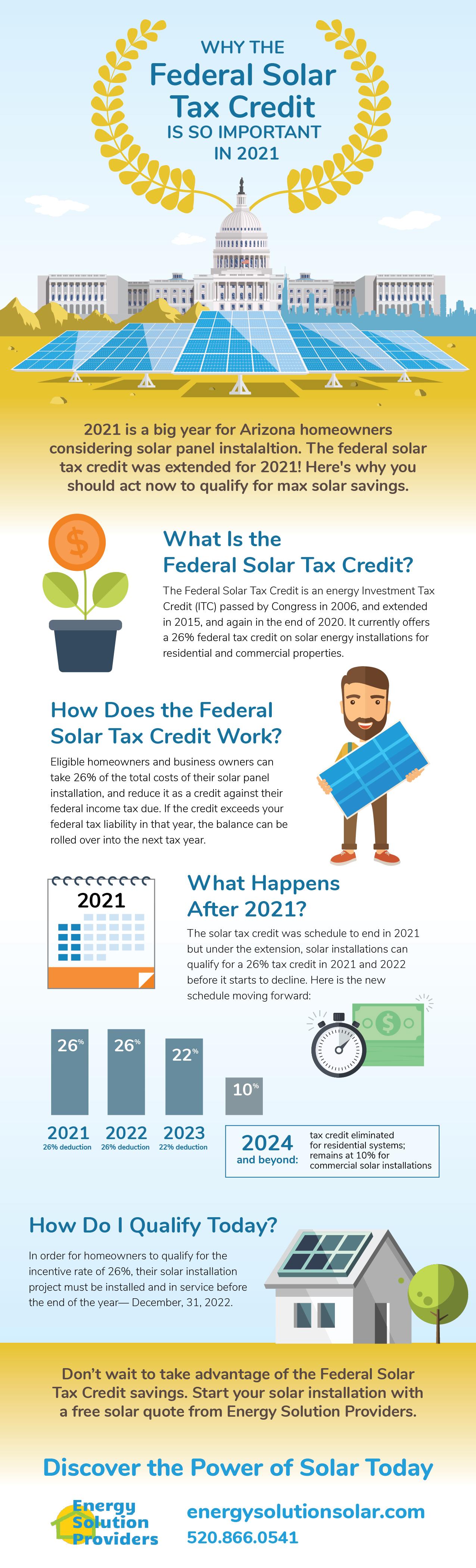

That is a nice bonus to add to the 26 Federal Solar Tax Credit. The maximum credit in a taxable year cant be more than 1000 regardless of the number of solar energy devices installed in the same home. Equipment and property tax exemptions.

If your tax liability is under the amount of the credit you can roll over the credit into subsequent tax years up to five years from your installation. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system. Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or wind energy device at the taxpayers Arizona residence.

Individuals receive a federal tax credit of 26 of the total solar system cost. Other Arizona tax credits have similar limits and these are outlined later on in this article. What Qualifies for the Solar Tax Credit.

Arizona also offers a 25 tax credit on up to 1000 of solar technology installed on a residence is available to homeowners. At the state level in Arizona not only is there is no sales tax charged but you can receive a state income tax credit of up to 1000 for a solar purchase. If you lived alone your total household income was less than 3751 live with others 5501.

Like the federal ITC in order to qualify for the Arizona solar tax incentive your system must be installed and commissioned before the end of the tax year you wish to file for. This credit offers 25 off the gross cost of the system up to a maximum credit of 1000. Residential Arizona Solar Tax Credit The Residential Arizona Solar Tax Credit gives you back 25 of the cost of your solar panel installation up to 1000 off of your income tax return in the first year you install the system according to EnergySage.

However the residential federal solar tax credit cannot be claimed when you put a solar PV system on a rental unit you own though it may be eligible for the business ITC under IRC Section 48. Arizona Department of Revenue. Arizonas Energy Systems Tax Credit.

However the state of Arizona does offer a tax credit that can be used on top of the federal solar tax credit. The most significant solar rebate offered in Arizona is the Credit for Solar Energy Devices from the Arizona Department of Revenue. Credit for Solar Energy Devices.

An income tax credit is also available at the state level for homeowners in Arizona. Known as the Residential Solar and Wind Energy Systems Tax Credit this incentive gives you a tax credit of 25 percent for your new solar energy system. The credit should be claimed in the year the system is placed into service.

The credit is allowed against the taxpayers personal income tax in the amount of 25 of the cost of a solar or wind energy device with a 1000 maximum allowable limit regardless of the number of energy devices installed. Arizona Residential Solar Energy Tax Credit Buy new solar panels in Arizona and get a 25 credit of its total cost against your personal income taxes owed in that year. The maximum credit in a taxable year cant be more than 1000 regardless of the number of solar energy devices installed in the same home.

Arizona offers an individual tax credit of 25 of the cost of the installation of a solar energy system worth up to 1000. Does Arizona have a solar tax credit. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system.

It slashes the cost of your installation by nearly a third via a 30 tax credit as long as your system meets the qualification criteria. Donors often wonder whether they can receive tax credits under the Arizona Charitable Tax Credit for smaller gifts. Arizona state tax credit for solar.

The federal Investment Tax Credit ITC is one of the major reasons many people choose to go solar. Arizona Residential Solar and Wind Energy Systems Tax Credit This incentive is an Arizona personal tax credit. The credit can be claimed the year of the installation of your solar system.

As a credit you take the amount directly off your tax payment rather than. No preapproval is required for an individual income tax credit for a residential Solar Energy Device tax credit that is claimed on Form 310. Solar PV systems do not necessarily have to be installed on your primary residence for you to claim the tax credit.

However keep in mind that this is a one-time tax credit and the homeowner is restricted from additional tax credits on. Many states also offer tax credits for solar. This tax credit is good through 2022.

Some will continue even after the federal credit expires. You paid property tax on your Arizona home OR paid rent on taxable property for the entire year. Credit for Contributions to Qualifying Charitable Organizations.

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

Solar Tax Benefits In Phoenix Arizona Solar Incentives

2021 Solar Tax Credit Sunsolar Solutions

Arizona Solar Tax Credit Other Incentives Available In 2022 Ecowatch

How The Solar Tax Credit Makes Renewable Energy Affordable

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

What Do Solar Panels Cost Residential Solar Price Breakdown

Solar Panels For Your Home What To Ask In 2020 Chariot Energy

Arizona Solar Tax Credits And Incentives Guide 2022

How The Solar Tax Credit Works Youtube

Solar Panel Incentives Rebates Tax Credits A Definitive Guide

The Federal Solar Tax Credit Energy Solution Providers Arizona

Arizona Solar Incentives And Rebates 2022 Solar Metric

Generac Power Systems Customer Support For Generac Generators Pressure Washers And Power Equipment

Federal Solar Tax Credit 2022 How Does It Work Sunpro Solar

Tax Credits For Installing Solar Panels

The Extended 26 Solar Tax Credit Critical Factors To Know